How Do You Create An Investment In Real Estate?

Investing in real estate can be a great way to generate income and build wealth. To begin investing in real estate, you need to understand the basics of the investment process and what options are available to you. Creating an investment in real estate requires research, an understanding of the market, and a sound strategy. You also need to understand the different types of investments available, the associated risks, and the necessary steps to launch and maintain investment. With the right knowledge and skills, you can create an investment in real estate that will yield profitable returns.

Understanding the Basics of Real Estate Investment

Investing in real estate can be a great way to generate income and build wealth. To get the most out of your real estate investments, it’s important to understand the basics of the real estate market and the different types of investments available. Real estate can be a complex and risky investment, so it’s important to do your research before diving in. This guide will provide an overview of the key elements of real estate investment, including the different types of investments, the potential risks and rewards, and tips for successful investing. With a better understanding of the basics, you will be well on your way to building a successful real estate portfolio.

Assessing the Risks of Real Estate Investment

Real estate investment is an attractive and lucrative opportunity for many, but it is important to assess the risks before taking the plunge. Fortunately, this can be done by researching the local market, understanding the potential risks associated with real estate investment, and taking measures to minimize those risks. Additionally, it is essential to seek the assistance of experienced professionals to help you navigate the complexities of real estate investment. By taking the time to properly assess the risks, real estate investors can maximize their returns and ensure a profitable and successful venture.

Choosing a Suitable Real Estate Investment

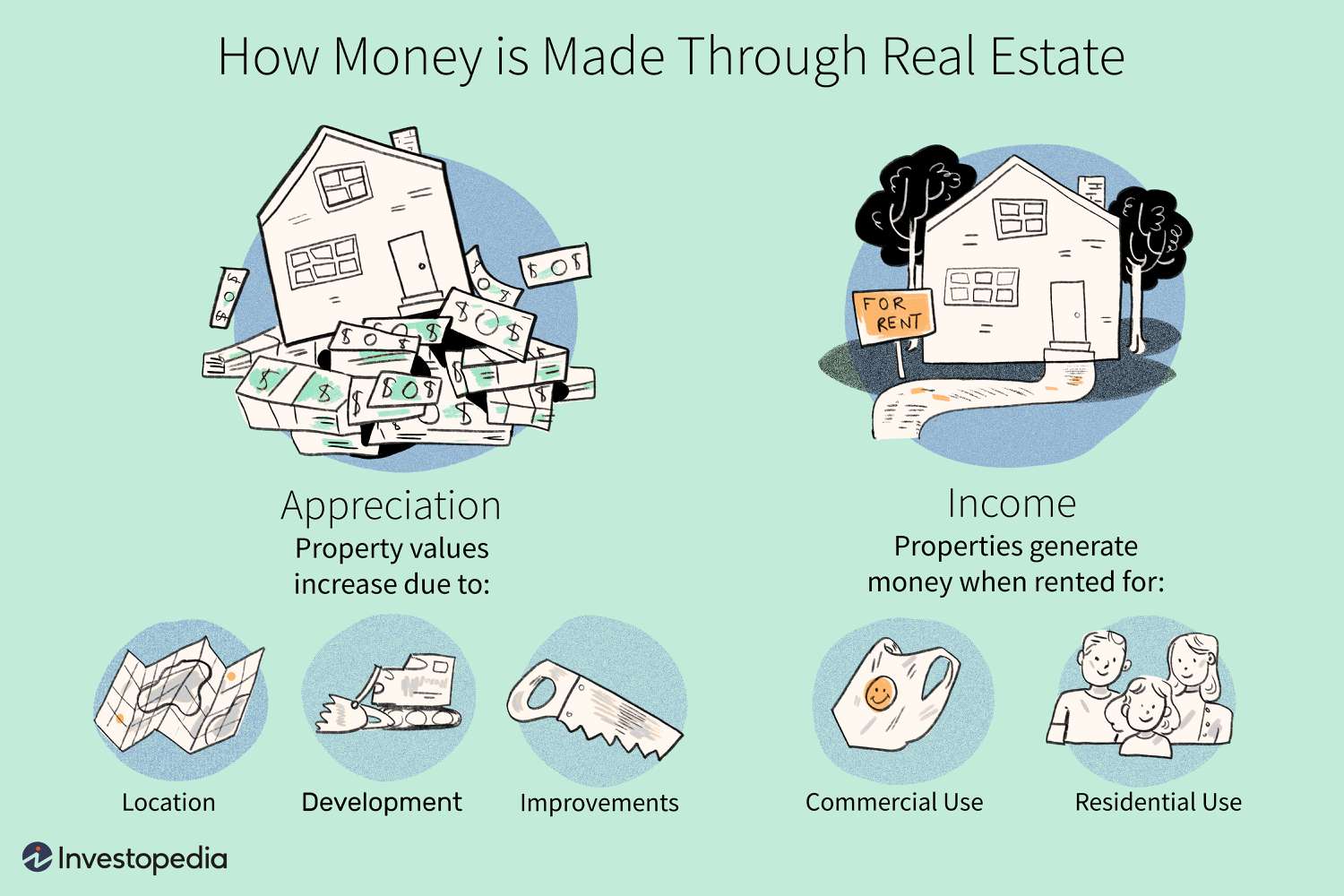

Real estate investment can be both rewarding and risky. Choosing the right investment is essential for making a successful return on your investment. When selecting a real estate investment, it is important to consider the location, potential appreciation, rental income, and other factors. You should also consider the type of investment, such as a single-family home, condominium, or apartment building. Researching the local market and understanding the legal and financial aspects of the transaction can help you make the best decision. Additionally, it is important to work with a reputable real estate agent and attorney to ensure you are making a sound investment. With the right research, dedication, and guidance, real estate investing can be a lucrative and rewarding endeavor.

Developing Your Investment Strategy

Developing an effective investment strategy is essential for any investor looking to maximize their returns. It is important to create a plan that is tailored to your individual financial goals and objectives. To do this, you should consider factors such as your risk tolerance, asset allocation, diversification, and investment timeline. Additionally, it is important to understand the different types of investments available, including stocks, bonds, mutual funds, and exchange-traded funds. With a comprehensive understanding of the options available, you can create an investment strategy that meets your specific needs and helps you reach your financial goals.

Financing Your Real Estate Investment

Real estate investment can be a great way to build wealth and generate income. However, financing your real estate investments can be tricky. It’s important to understand the different financing options available, as well as the advantages and disadvantages of each. This blog will provide insight into the best ways to finance your real estate investments, from traditional mortgage loans to creative financing strategies. We’ll discuss the details of each option and provide guidance on how to make the best decisions for your financial situation. With this information, you’ll be able to make informed decisions and maximize your real estate investment returns.

Maximizing Your Return on Investment

Maximizing your Return on Investment (ROI) is essential for any business, large or small. Every dollar spent needs to be accounted for, and you need to ensure that your investment is working for you. By creating an effective ROI strategy, you can analyze the costs and benefits of your investments and ensure that you’re getting the most out of each one. This blog section will help you understand the basics of ROI and how to maximize it in order to increase your profits. We’ll cover topics such as budgeting, cost-benefit analysis, and tracking your ROI to make sure you’re getting the most out of every dollar. We’ll also provide tips and tricks on how to get the most out of every investment, so you can make the most of your business’s bottom line.

Managing Your Real Estate Investment

Real estate investment is one of the most powerful methods of building long-term wealth, but it can also be one of the most challenging. Managing your real estate investments means understanding the market, making the right decisions on investments, and managing the day-to-day operations. This blog will provide you with advice, tools, and resources to help you navigate the complexities of real estate investing. You’ll learn about different strategies, market trends, property management basics, and more. With this knowledge, you’ll be empowered to make the best decisions for your real estate portfolio and maximize your returns.

Understanding Tax Implications of Real Estate Investment

Real estate investing is an attractive option for many, but it is important to understand the tax implications that come along with it. Investing in real estate can have a number of positive tax benefits, but there are also several tax considerations to keep in mind. From deductions to capital gains taxes, investors must understand the implications of their investments and how to maximize their savings. This blog post explores the tax implications of real estate investments, including deductions, capital gains, and more, to help investors make informed decisions and maximize their returns.

FAQs About the How Do You Create An Investment In Real Estate?

Q1: What are the different types of real estate investments?

A1: The three main types of real estate investments are residential, commercial, and industrial. Residential investments are properties used for housing and typically include single-family homes, duplexes, apartments, and condominiums. Commercial investments involve properties used for business such as offices, retail stores, and warehouses. Industrial investments involve properties used for manufacturing and production purposes.

Q2: What are the advantages of investing in real estate?

A2: Investing in real estate can provide a range of benefits including potential tax advantages, appreciation potential, passive income, and diversification. Real estate also tends to be a relatively stable investment compared to other asset classes.

Q3: What should I consider before investing in real estate?

A3: Before investing in real estate, it is important to consider factors such as the location of the property, the condition of the property, the expected return on investment, and the associated costs and risks. It is also important to understand the type of real estate investment you are considering and to research the local market.

Conclusion

Investing in real estate can be a great way to increase your wealth and build your portfolio. By researching the local market, understanding the costs and risks associated with the investment, and creating a plan to achieve your goals, you can create a successful real estate investment. With the right strategy and a bit of patience, you can be well on your way to becoming a successful real estate investor.