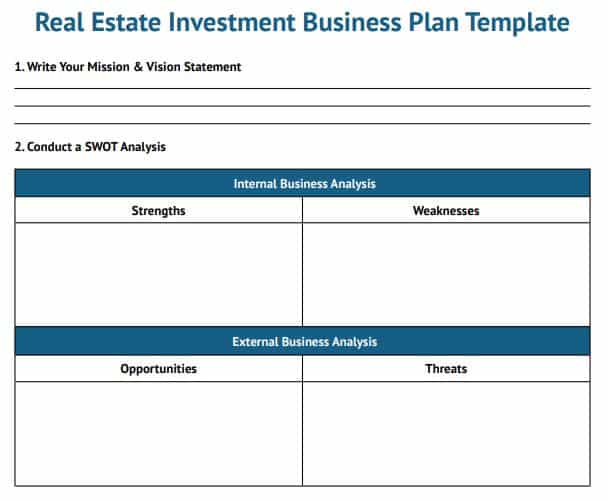

How Do You Write An Investment Business Plan?

An investment business plan is a document that outlines a business’s goals, strategies, and objectives for achieving success in the investment industry. It is a tool used by investors and potential investors to evaluate the potential of a business and assess its long-term prospects. A successful investment business plan is comprehensive, includes a detailed financial analysis, and outlines the risks and rewards of investing in the business. The plan must also include a detailed strategy for achieving success, including an assessment of the competitive landscape, an analysis of the target market, and a marketing plan. Finally, the plan must include a comprehensive risk management strategy. Writing an investment business plan is not an easy task, but it is an essential part of planning any business venture.

Overview of Investment Business Planning

Investment business planning is the process of creating a comprehensive plan that outlines how an investment business will be managed and operated. It involves assessing the current state of the business and the potential for success in the future, setting financial and operational goals, and developing strategies to meet those goals. The plan should also include strategies for mitigating risks and adapting to changes in the market, as well as an analysis of the competitive landscape. A well-developed business plan should provide investors and stakeholders with the confidence to invest in the business. A successful investment business plan should be clear, concise, and persuasive, and provide a roadmap for the future of the business.

Understanding Your Investment Business Model

Understanding your investment business model is essential for achieving success in the financial markets. By developing a clear understanding of the different types of investments, the risks associated with them, and the strategies you can use to maximize returns, you can create a profitable and sustainable portfolio. Investing can be an exciting and rewarding experience, but having a well-defined business model is essential for success. It is important to understand the types of investments you are making, the expected returns, the level of risk involved, and the strategies you can use to maximize those returns. Additionally, you must understand the regulations and laws that govern the investment industry, as well as any fees and taxes associated with your investments. Developing an understanding of your investment business model is the key to success in the financial markets.

Defining Your Investment Goals

Investing can be a great way to grow your wealth over time, but it’s important to have a plan in place to make sure you’re reaching your financial goals. Defining your investment goals is the first step in creating a portfolio tailored to meet your needs. Consider what you want to achieve, how much risk you’re willing to take, and how much time and effort you’re willing to devote to your investments. This will help you determine what types of investments are right for you and where to put your money. Once you’ve defined your investment goals, you can create a plan to help you achieve them.

Developing a Financial Plan

Developing a financial plan is essential for any individual or family who wants to achieve financial security and stability. It helps to ensure that you are able to meet your short-term and long-term financial goals while also providing a roadmap for how to get there. A financial plan will help you identify areas of your finances that are working well and areas that need attention. It will also help you to develop strategies to ensure that you are making the most of your resources and that you are prepared for any unexpected events. A financial plan should be reviewed and updated regularly to ensure that your financial goals are still achievable and that you are staying on track. Taking the time to develop a financial plan can save you time, money, and stress in the long run.

Outlining Your Investment Strategy

Creating a sound investment strategy is an important part of any investor’s journey to financial success. Outlining your investment strategy involves determining your investment goals, risk tolerance, timeline, and financial resources. You’ll need to consider the type of investments that are suitable for your situation, including stocks, bonds, mutual funds, and other options. Setting yourself up for success requires a comprehensive understanding of the different asset classes and how they may fit into your overall investment plan. Additionally, you’ll need to make sure that your strategy is tailored to your individual life goals and financial objectives. When done correctly, outlining your investment strategy can help you stay on track and reach your financial goals.

Implementing Your Investment Business Plan

In order to make your investment business successful, it is important to have a well-thought-out business plan. Implementing your investment business plan can be a daunting task, but it doesn’t have to be. Start by researching your industry and the potential return on your investments. Consider the resources you need to get started, such as capital, personnel, and other necessary resources. Create a timeline for when you want to achieve your goals and set milestones along the way. Finally, establish a budget and track your progress. By taking these steps, you can make your investment business profitable and successful.

Analyzing Your Investment Results

Investing your hard-earned money is never an easy task. There are so many different aspects to consider before you make a decision. However, the most important part of investing is analyzing your results. You need to look at the data and understand how your investments are performing. This blog covers the fundamentals of analyzing your investment results. It explains how to interpret the data, what to look out for, and how to use the information to your advantage. It also provides a comprehensive guide on how to accurately assess the performance of your investments. By taking the time to properly analyze your investment results, you can ensure that you are making the best decisions for your financial future.

Considerations for Ongoing Investment Business Planning

Businesses need to plan for their long-term success, but they must also plan for the short-term. Ongoing investment business planning is a critical part of any business strategy. It involves taking into account current market trends, industry dynamics, and other factors that may affect the business. It also involves understanding the company’s financial position, how much money is available for capital investments, and how to best use it. The goal is to ensure the business is able to grow and remain profitable over time.

Ongoing investment business planning should include a clear vision of what the business wants to achieve. This includes understanding the company’s goals, how to reach them, and identifying the resources needed to make it happen. Additionally, it’s important to anticipate potential risks and plan for how to respond to them. Finally, ongoing investment business planning should consider how to measure success and adjust the plan as needed. By taking the time to plan for the long term, businesses can ensure they remain competitive and successful.

FAQs About the How Do You Write An Investment Business Plan?

Q1: What are the key components of an investment business plan?

A1: An investment business plan should include an executive summary, market analysis, competitive analysis, product/service overview, operations and management plan, financial plan, and an appendix.

Q2: What information should I include in my investment business plan?

A2: The information you include in your investment business plan should depend on the type of business you’re starting. Generally, information such as your company’s legal structure, products/services you are offering, the target market, financials, and marketing strategies should be included.

Q3: What resources are available to help me write an investment business plan?

A3: There are numerous resources available online to help you write an investment business plan. Some resources include business plan templates, planning software, online courses, and business plan writers. Additionally, you can seek advice from mentors, consultants, or financial advisors that specialize in business planning.

Conclusion

Writing an investment business plan is essential for any business that is looking to raise capital from potential investors. An effective plan will outline the company’s goals and objectives, identify key market opportunities, and provide a comprehensive financial analysis. It should also provide an overview of the company’s competitive advantages and the strategies it plans to implement to capitalize on those advantages. Finally, the plan should demonstrate an understanding of the risks associated with the venture and how the company intends to mitigate those risks. A well-developed investment business plan will be an invaluable tool in helping you secure the capital you need to launch or expand your business.