How Does Mortgage Broker Help?

Mortgage brokers are professionals who specialize in helping homeowners secure mortgages for their homes. They work with a variety of lenders to help borrowers find the best loan terms available for their individual financial situation. Brokers have access to a variety of loan programs and can offer special deals or better terms than a borrower may be able to find on their own. They often save borrowers time and money by researching and comparing loan options, and they can ensure that paperwork and other requirements are met. Brokers also provide advice on mortgage terms and other aspects of the home-buying process. If you’re considering purchasing a home, a mortgage broker can help you navigate the complicated process and find the best loan for your situation.

What is a Mortgage Broker?

A mortgage broker is a professional who helps you navigate the complex world of home loans. By leveraging their expertise and knowledge of the industry, they can help you find the best loan to meet your specific financial goals. Mortgage brokers can help you compare loan products from different lenders and negotiate better terms and rates. They can also provide guidance and advice on the right loan product for your particular situation. With a mortgage broker, you can feel assured that you’re getting the best loan for your needs.

What Services Does a Mortgage Broker Offer?

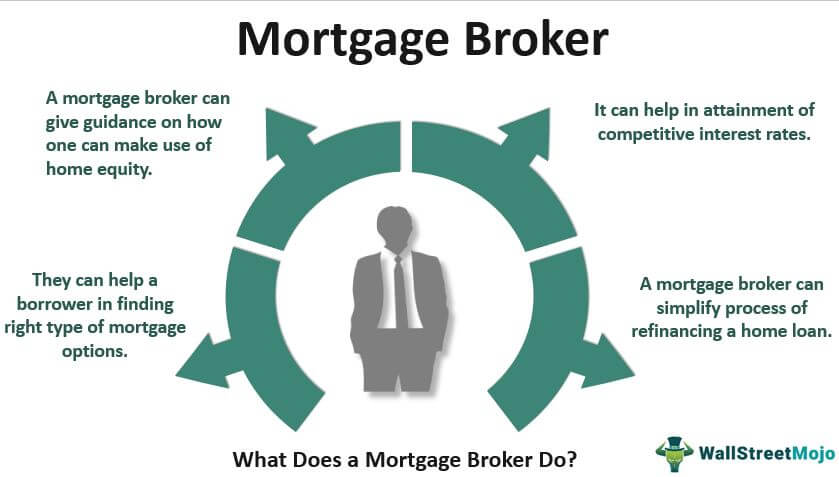

A mortgage broker is a professional who serves as an intermediary between a borrower and a lender to assist in obtaining a mortgage loan. Mortgage brokers act as advisers to their clients, helping to assess their financial situation and guide them toward the best loan product to suit their individual needs. They can assist with finding the lowest interest rate, and the best loan terms and conditions, and can provide assistance with the home loan application process. Additionally, they can provide advice on budgeting, credit, insurance, and other related financial topics. A mortgage broker’s services can save you time and money, while helping you make an informed decision about the best loan product for you.

Benefits of Using a Mortgage Broker

Using a mortgage broker can be an invaluable tool when it comes to navigating the complex and often confusing world of mortgages. Mortgage brokers have access to a wide range of lenders and products, which gives them the ability to find the best deal for their clients. Mortgage brokers are also able to provide advice and guidance on the various mortgage options available, helping clients make informed decisions on what is best for them. They can also provide assistance in completing the various paperwork needed to secure a mortgage. As mortgage brokers are not affiliated with any particular lender, they remain unbiased and independent in their advice – making them ideal for those looking for impartial guidance. Ultimately, using a mortgage broker can save time, money and a lot of stress when it comes to finding the perfect mortgage for you.

How to Choose the Right Mortgage Broker

Choosing the right mortgage broker can be a difficult task. It is important to evaluate the services they offer and their experience in the field. Here are a few tips to help you make the right decision:

- Research: Do some research to find out more about the potential broker and what services they offer.

- Experience: Make sure the broker has plenty of experience and is knowledgeable about the mortgage market.

- Fees: Be sure to ask about fees and other costs associated with the broker’s services.

- Licensing: Make sure the broker is properly licensed and certified to operate in your state.

- Reviews: Check customer reviews to get an idea of the broker’s reputation.

By following these tips, you can be sure to find the right mortgage broker for your needs. With the right broker, you can save money and time, and find the best mortgage solution for your situation.

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

The Mortgage Broker Process

The mortgage broker process is an invaluable asset for those who are looking to purchase a property. It is a simple yet efficient system that takes the stress and confusion out of the home-buying experience. Mortgage brokers act as intermediaries between lenders and borrowers, and provide impartial advice and assistance in finding the best mortgage product for their specific needs. They provide a free consultation and review of the borrower’s financial situation and credit history and then shop around for the best rate and terms for the borrower. This process ensures that the borrower is getting the best deal possible, thus saving them both time and money. By taking advantage of the services offered by a mortgage broker, borrowers can be confident that they are getting the best deal for their mortgage loan.

Common Questions About Mortgage Brokers

Mortgage brokers are professionals who can help you secure the best available mortgage for your individual circumstances. They can answer any questions you have about the process, and provide guidance to ensure you make the right decision. Common questions about mortgage brokers include: What do they do? Mortgage brokers are experts in finding suitable mortgages, based on your unique circumstances. They assess the mortgage market to identify the right deal for you and provide advice and support throughout the process. What fees do they charge? Mortgage brokers typically earn a commission from the lender, but you may also be required to pay an upfront fee for their services. Be sure to ask your broker about any fees upfront, so that there are no surprises later. How do I know if I can trust them? A reputable mortgage broker will be qualified and regulated by the relevant authorities. They should also have a long history of successful deals, and be willing to provide references from past clients.

The Advantages of Using a Mortgage Broker

Mortgage brokers are experienced professionals who specialize in helping individuals and businesses secure favorable mortgage terms. By utilizing a mortgage broker, you benefit from their extensive network of lenders, expertise in the mortgage industry, and ability to negotiate on your behalf for the best possible rate and terms. With the help of a mortgage broker, you can save time and money by having them compare mortgage rates and terms from various lenders to find the one that best suits your needs. Additionally, they will help you understand the entire mortgage process and provide advice on how to maximize your borrowing ability. In short, engaging the services of a mortgage broker can be a smart choice for those looking to secure the best possible mortgage terms.

The Disadvantages of Using a Mortgage Broker

Mortgages are a large financial commitment, and it can be difficult to know where to start when it comes to finding the right one. While using a mortgage broker can be beneficial in some cases, it is important to understand the potential disadvantages of using one. Mortgage brokers are not regulated in the same way as banks, so there is no guarantee that they will have your best interests at heart. Additionally, they often have access to only a limited range of mortgage products, meaning you may not get the best deal for your circumstances. Mortgage brokers also often add additional fees to your loan, which can add to the overall cost of the loan. Finally, using a mortgage broker can add plenty of time to the loan process, as they must go through the process of finding the right loan for you. All of these factors should be considered before committing to using a mortgage broker.

FAQs About the How Does Mortgage Broker Help?

Q. What is a Mortgage Broker?

Answer. A Mortgage Broker is a professional who acts as a middleman between borrowers and lenders. They typically have access to many different types of loans and can help borrowers find the best loan for their needs.

Q. How does a Mortgage Broker help?

Answer. A Mortgage Broker can provide advice and guidance on the best loan for your needs, as well as help you compare different loan products. They can also assist in the application process and provide access to a wide range of lenders.

Q. Are there any fees associated with using a Mortgage Broker?

Answer. Yes, most Mortgage Brokers will charge a fee for their services. This fee is usually based on a percentage of the loan amount. It is important to ask your Mortgage Broker about any associated fees before making a commitment.

Conclusion

Mortgage brokers can be a great asset to any homebuyer. They are knowledgeable about the lending industry and can help homebuyers find the right loan for their needs. They can also provide advice on how to make the best decisions for their finances. Mortgage brokers can help homebuyers save money by getting them the lowest rates and helping them understand and navigate the complex process of financing a home. Ultimately, mortgage brokers can be a helpful addition to the home-buying process and help homebuyers make the best decisions for their families.