What Is The Best Business Structure For A Moving Company?

A moving company is a great business to consider starting, as it has the potential to be both profitable and personally rewarding. When you’re starting a business, it’s important to consider which business structure will be the best for your company. The most common business structures for a moving company are sole proprietorship, limited liability company (LLC), and corporation. Each of these business structures comes with its own unique advantages and disadvantages, so it’s important to weigh your options and consider which one is best for you. Each structure has its own tax implications and business requirements, so you should discuss the options with an experienced business attorney or accountant.

Overview of Business Structures

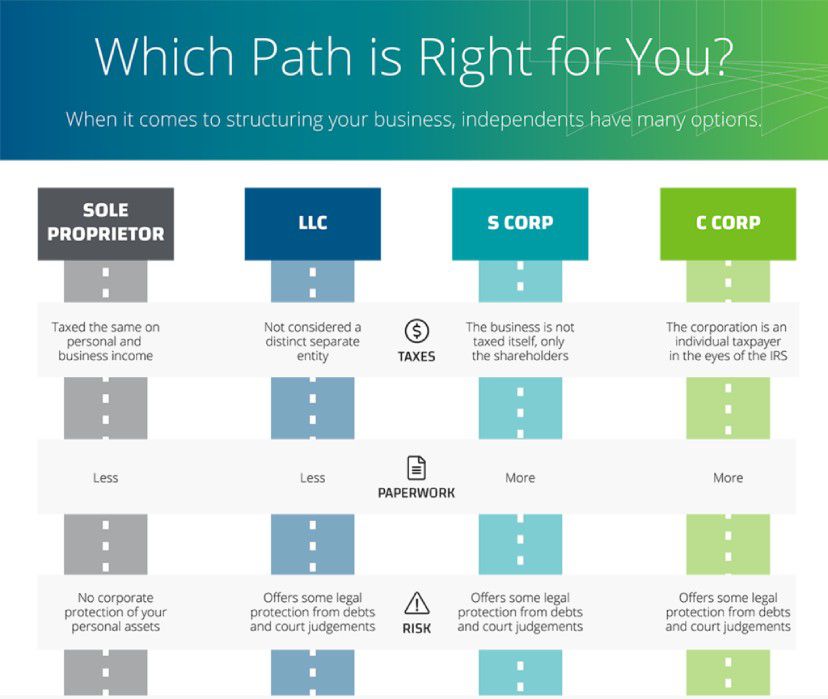

Business structures refer to the different ways an organization can be set up to conduct business. There is a wide variety of business structures available, each with its own advantages and disadvantages. A sole proprietorship is the simplest and most common form of business organization, involving a single owner who is personally responsible for liabilities and debts. Partnerships involve two or more individuals who agree to share ownership of the business, profits, and liabilities. Corporations are separate legal entities owned by shareholders and managed by directors and officers. Limited liability companies (LLCs) offer a combination of the flexibility of a partnership with the limited liability of a corporation. Finally, cooperatives are business organizations owned and operated by members who share in the profits and losses.

No matter the type of organization chosen, it is important to understand the legal and financial implications of each type of business structure. An experienced business lawyer can provide invaluable advice on the best type of business structure for your situation.

Advantages of a Sole Proprietorship

A sole proprietorship is the simplest, most common form of business. It is a great choice for those who are just starting out or who are looking to operate a business with minimal red tape. It offers a number of advantages over other business structures, such as a simple and inexpensive setup, complete control and flexibility, ease of management, and direct profits. It also offers the owner a range of tax benefits, including the ability to deduct operating expenses, and the ability to report business profits and losses directly on the owner’s personal income tax return. A sole proprietorship can provide a great opportunity for entrepreneurs to quickly and easily begin their business journey.

Disadvantages of a Sole Proprietorship

A sole proprietorship is a form of business ownership in which an individual is responsible for all of the assets and liabilities of the business. While this arrangement offers a variety of benefits, it is important to be aware of the potential drawbacks. These include unlimited personal liability, difficulty obtaining financing, and difficulty in succession planning.

Unlimited personal liability means that the owner is personally responsible for any debts or obligations incurred by the business. This can be a significant risk, as the business owner’s personal assets can be used to satisfy any legal claims or judgments against the business. Additionally, sole proprietorships may have difficulty obtaining financing, as lenders are typically unwilling to extend business loans without some form of collateral. Lastly, planning for the future can be difficult in a sole proprietorship, especially if the owner plans to retire or pass on the business to another person.

Advantages of a Limited Liability Company

A Limited Liability Company (LLC) offers several distinct advantages that make it a popular choice for many business owners. An LLC provides owners with limited liability protection from debts and obligations of the business. This means that creditors of the business can only seek to collect from the business itself, and not from the personal assets of the members or owners of the LLC. Additionally, an LLC can offer its members the ability to pass through income and losses directly to the owners’ personal tax returns, reducing the amount of taxes paid by the LLC and its members. Finally, LLCs offer more flexibility in managing the business and the ability to have different classes of ownership than traditional corporations. These advantages make the LLC a popular choice for many business owners.

Disadvantages of a Limited Liability Company

A Limited Liability Company (LLC) is a business structure that limits the personal liability of the owners for the debts and obligations of the company. While this structure can provide many advantages, such as tax savings and asset protection, there are also some potential drawbacks to choosing an LLC. The main disadvantage of an LLC is the complexity associated with managing and operating the business. LLCs must follow certain corporate formalities, including maintaining separate bank accounts, preparing and filing annual reports, and following certain formalities when it comes to holding meetings and taking action. Additionally, LLCs are subject to double taxation, meaning that income is taxed on both the corporate level and the individual level. Lastly, LLCs may be more expensive to form and maintain than other business structures.

Advantages of a Corporation

A corporation is a great business structure for those looking to maximize potential and minimize risk. As a separate legal entity, the corporation protects its owners from any personal liability and allows for the separation of ownership and management. Furthermore, corporations have the ability to raise capital by issuing stocks and bonds, allowing them to grow more quickly than other business structures. Additionally, corporations are subject to certain tax benefits. For example, profits are taxed only once as a corporate entity, rather than being taxed twice (once for the corporation and once for the owners). Ultimately, corporations provide owners with the ability to maximize potential, minimize risks, and benefit from tax advantages, making it a great option for businesses looking to grow.

Disadvantages of a Corporation

A corporation is a business structure that provides limited liability to its owners, meaning that shareholders are not held personally liable for the company’s debts or liabilities. While this is an advantage, there are also some notable disadvantages to forming a corporation. One of the primary disadvantages of a corporation is the cost of formation and maintenance. Corporations must adhere to numerous legal regulations and requirements and must pay fees to the government for incorporating and filing annual reports. Additionally, corporate taxes are typically higher than personal taxes, which can be a burden on profits. Corporations can also be difficult to manage, as the ownership and management of a corporation are separate, leading to potential conflicts of interest. Finally, corporations are complex entities, making them time-consuming to maintain and less flexible than other business structures.

FAQs About the What Is The Best Business Structure For A Moving Company?

1. What are the advantages of setting up a moving company as a limited liability company (LLC)?

An LLC offers the protection of personal assets from business debts and liabilities, as well as the potential for tax savings and the ability to have multiple owners.

2. What type of licensing is required to start a moving company?

Most states require a business license or permit for a moving company. Depending on the state, additional licensing may be required such as an insurance license, driver’s license, and/or a special transportation permit.

3. Are there any special regulations that apply to moving companies?

Yes, every state has its own set of regulations that apply to moving companies. Regulations may include filing an annual report, following safety requirements, and submitting a criminal background check for employees.

Conclusion

The best business structure for a moving company is likely to be either a sole proprietorship or a limited liability company. Both offer flexibility, low startup costs, and protection from personal liability. The most important factor when deciding on a business structure is to consider the company’s goals and the risks associated with them. Additionally, consulting with a business attorney to determine the best legal structure for the company is a sound strategy.