Why Are Homes In Charlotte So Expensive?

The city of Charlotte, North Carolina is one of the fastest-growing cities in the country. With its booming economy, vibrant culture, and abundance of job opportunities, Charlotte has become a desirable place to live for many people. Unfortunately, the housing market in Charlotte has been steadily increasing, resulting in high housing costs. This has caused many people to question why homes in Charlotte are so expensive. There are a few factors that have contributed to the high cost of housing in Charlotte, including a shortage of available housing, a booming population, and the city’s popularity as a destination for businesses and tourists. All of these factors have combined to make Charlotte one of the most expensive cities in the United States.

Understanding the Housing Market in Charlotte

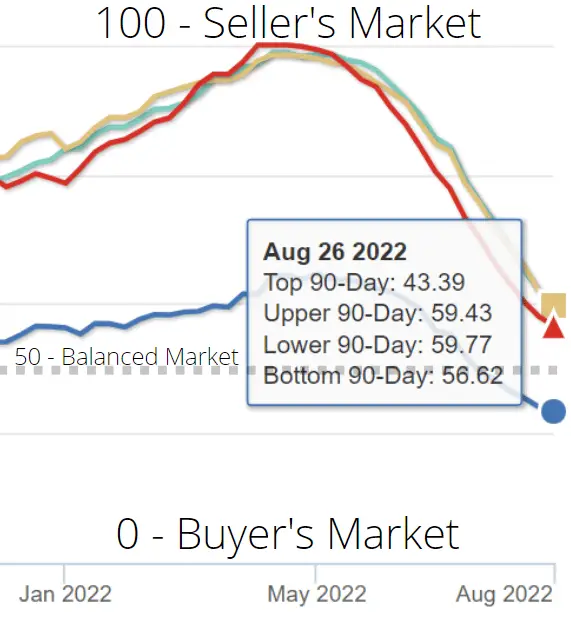

The Charlotte housing market is constantly changing and evolving, making it difficult to predict the future. Knowing the current trends and understanding the city’s housing market can help you make the best decisions when it comes to your real estate investments. Staying informed about the market’s fluctuations and trends can help you stay ahead of the curve and make smart decisions when it comes to buying or selling a home. From the city’s median home value to the number of homes on the market, understanding the current housing market in Charlotte can help you make an informed decision and potentially save you money.

Economic Factors Impacting Home Prices

Home prices are affected by a variety of economic factors, including the rate of inflation, interest rates, and the availability of credit. Inflation can have a significant effect on home prices, as rising prices of goods and services can lead to a corresponding increase in home prices. Interest rates are also important, as they impact the cost of borrowing money to purchase a home. When interest rates are low, buying a home can become more affordable and increase demand, resulting in higher prices. Finally, the availability of credit can also play a role in home prices. When credit is easily accessible, buyers can purchase more expensive homes, leading to increased demand and higher prices. It is important for buyers to consider these economic factors when purchasing a home.

Comparing Home Prices to Other Cities

Comparing home prices to other cities is an important step in the home-buying process. When you’re looking for the perfect property, it’s important to know how the price of your dream home in one city stacks up against similar homes in other cities. By researching the average prices of homes in the areas you’re considering, you can get a better idea of what to expect in terms of pricing and compare it to other cities. Doing your research can help you find the perfect home at the right price.

Demand for Housing in Charlotte

The city of Charlotte, North Carolina has become a hot spot for people looking to settle down. With its growing economy and diverse culture, Charlotte has something for everyone. The demand for housing in Charlotte has increased in recent years, as more and more people flock to the city. With its bustling downtown and vibrant neighborhoods, Charlotte offers a variety of housing options to meet the needs of its growing population. From luxury condos to cozy single-family homes, Charlotte has something to offer everyone. With its growing job market and excellent school systems, Charlotte is the perfect place to call home. So, if you’re looking for a place to call home, you don’t have to look any further than Charlotte, North Carolina.

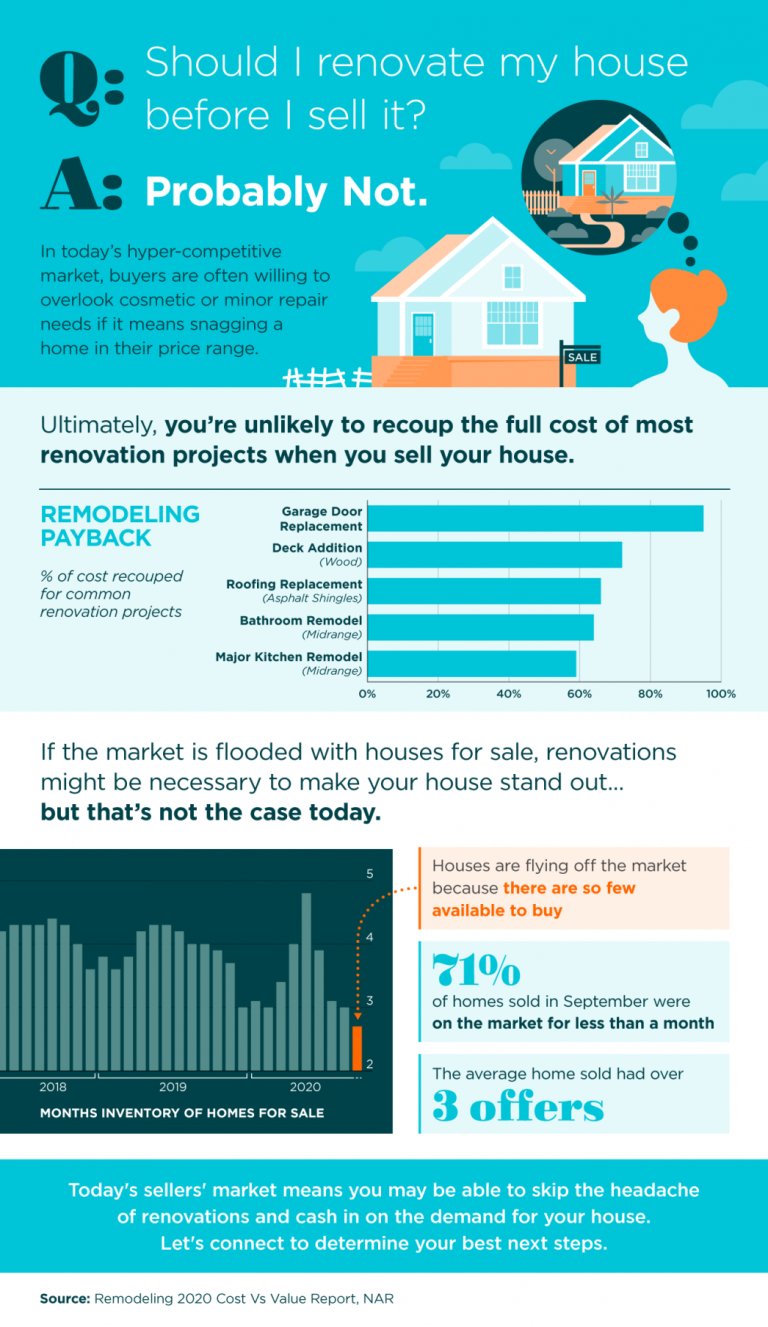

Supply and Availability of Homes in Charlotte

The housing market in Charlotte, North Carolina is booming, with the supply of available homes increasing at a rapid rate. This is great news for potential buyers, as it means there is plenty of choice on the market. The increased availability of homes also means that prices are competitive, making it easier for buyers to find a property that fits their budget. Moreover, Charlotte’s growing population means that there is a steady influx of people looking for housing, further increasing demand and availability. With a wide range of homes on the market, Charlotte is an ideal place to purchase a home and start a family.

Historical Property Values in Charlotte

The Charlotte housing market has experienced remarkable growth over the past several decades, making it an attractive destination for many homebuyers. Historical property values in Charlotte offer a unique insight into the city’s development over time. By taking a look at the values of properties in Charlotte throughout the years, we can gain a better understanding of the city’s past and the changes that have occurred in its real estate market. This blog provides an in-depth look at the historical property values in Charlotte, from the early 1900s to the present day. We’ll explore the factors that have influenced the city’s housing market and the changes that have taken place over the years. We’ll also discuss the city’s current property values and what that means for the future. So join us as we take a deep dive into the historical property values in Charlotte – the past, present, and future.

Impact of Development and Urbanization

The development and urbanization of towns and cities have had a profound impact on our modern society. The rapid influx of people moving from rural to urban areas has led to an increase in population density and a shift in lifestyles, from traditional to more modern ways of living. This has brought about changes in infrastructure, public services, and the economy, with the emergence of new industries and job opportunities. Moreover, these changes have also had a visible effect on the environment, with increased land degradation and pollution. While the positive effects of development and urbanization should not be overlooked, the negative impacts on the environment should be considered and addressed in order to ensure a sustainable future.

Strategies for Making Homeownership More Affordable

Homeownership can be a daunting and expensive endeavor, but there are strategies to make it more affordable. First, research your options to understand the costs of home ownership. Determine the type of loan you qualify for and the best interest rates available. Next, set a budget and plan for the future. Create a savings plan that includes homeownership funds, such as a down payment and closing costs. Consider working with a financial advisor to create a budget and savings plan that fits your financial goals. Additionally, look into grants and other assistance programs that could help make homeownership more affordable. Lastly, shop around for the best mortgage and compare rates and terms from different lenders. Doing your due diligence can save you money in the long run. With a little research and strategizing, homeownership can be an affordable and rewarding experience.

FAQs About the Why Are Homes In Charlotte So Expensive?

1. What factors have contributed to the high cost of real estate in Charlotte?

Answer: Charlotte has seen an influx of people and businesses due to its growing economy and desirable location. This influx of people has caused the demand for housing in Charlotte to exceed the available supply, leading to higher prices for homes. Other factors such as low mortgage rates, high wages, and a competitive real estate market have also been contributing factors.

2. How does the current housing market in Charlotte compare to other cities in the region?

Answer: Charlotte’s housing market has been consistently ranked as one of the most expensive in the region. The median home price in Charlotte is currently higher than the median home price in cities such as Raleigh, Durham, and Greensboro.

3. Is there anything I can do to make a home purchase in Charlotte more affordable?

Answer: Yes, there are several strategies that may help make a home purchase in Charlotte more affordable. These include looking for properties in lower-priced neighborhoods, taking advantage of down payment assistance programs, and considering alternative financing options such as FHA and VA loans. Additionally, some lenders offer reduced interest rates for buyers with good credit.

Conclusion

The cost of homes in Charlotte is so expensive due to the city’s strong economy, high demand for housing, rising population, and limited supply of available land. Charlotte is a desirable place to live, and the city’s growth has resulted in the rise of home prices in the area. Despite the high cost of homes in Charlotte, there are still opportunities to purchase affordable housing, especially if buyers are willing to look for homes in the surrounding suburbs or smaller towns.