India Real Estate Market

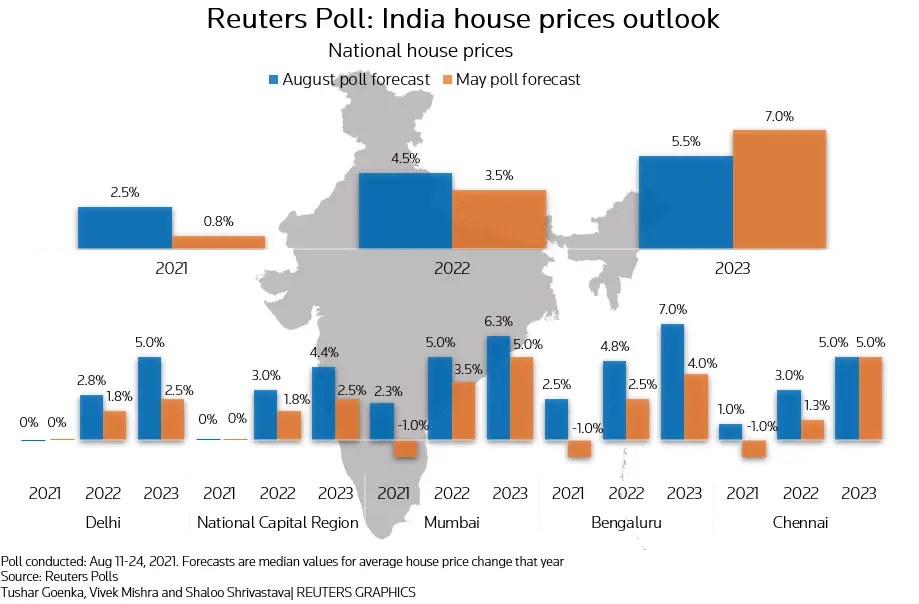

The Indian real estate market is one of the largest in the world. It has been growing at a rapid pace for the past decade and is expected to continue to do so in the years ahead. The growth is due to the country’s strong economic growth, urbanization, and an expanding middle class. The market is driven by residential, commercial, and IT/IT segments. The government has also been encouraging foreign investments in the sector, which has been a major contributor to the growth. The Indian real estate market is currently worth approximately $180 billion and is projected to reach $1 trillion by 2030.

Overview of Indian Real Estate Market

The Indian real estate market is one of the most lucrative and attractive markets in the world. India has the world’s second-largest population, and that means there is a steady stream of people looking to invest in property. The Indian real estate market offers investors a range of opportunities, including residential, commercial, industrial, and agricultural properties. As the country continues to develop at a rapid pace, the demand for housing and other real estate investments continues to increase.

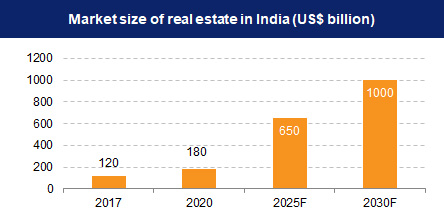

Real estate prices in India are highly dependent on the location and size of the property. Properties in major cities like Mumbai and Delhi tend to fetch a higher price than properties in smaller cities. The overall trend is that the real estate market is growing steadily, with prices increasing as demand grows and supply dwindles.

Real estate investments in India are also influenced by the government’s policies and regulations. In recent years, the government has introduced measures to make it easier for people to buy property, such as tax incentives and simplified loan procedures. These measures have helped to boost the real estate market and have made it more attractive to investors.

Overall, the Indian real estate market is an attractive option for investors. With its vast population, steady economic growth, and government incentives, the Indian real estate market provides investors with a range of opportunities. With the right research and the right strategies, investors can make the most of the opportunities in this promising market.

Economic Factors Impacting Indian Real Estate Market

The Indian real estate market is a key contributor to the nation’s economy, but its success is greatly impacted by a variety of economic factors. From changes in monetary policy to the cost of raw materials, economic factors can have an enormous effect on the Indian real estate market. Potential homebuyers and investors in the Indian real estate market need to understand how these changes can affect their investments.

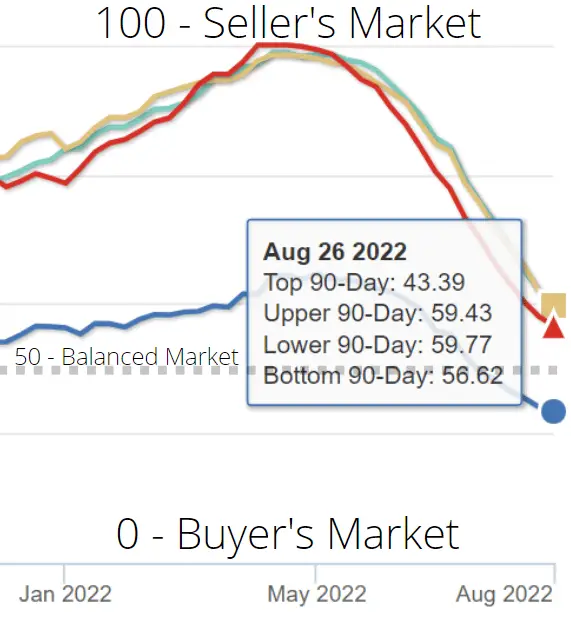

Interest rates play a significant role in the Indian real estate market. When interest rates are low, buyers can finance their home purchases more easily, leading to an increase in demand for housing. On the other hand, when interest rates are high, buyers become more cautious, leading to a decrease in demand.

Inflation is another important economic factor that can greatly impact the Indian real estate market. When inflation rises, the cost of raw materials and other building costs increase, leading to higher home prices. This can make it more difficult for homebuyers to purchase a home, as they may not be able to afford the higher prices. Conversely, when inflation is low, the cost of raw materials and building costs decrease, allowing homebuyers to purchase homes more easily.

The cost of labor is another economic factor that can affect the Indian real estate market. When labor costs increase, builders must increase the prices of their homes to cover their costs. This can make it more difficult for buyers to purchase a home, as they may not be able to afford the higher prices. On the other hand, when labor costs are low, builders can keep their prices more competitive, making it easier for buyers to purchase a home.

Regulations and Policies Influencing the Indian Real Estate Market

India’s real estate market is heavily regulated and influenced by various government policies. These regulations and policies have a direct and indirect impact on the market and can influence the demand and supply of real estate, prices, availability of credit, and overall investment decisions.

The Real Estate (Regulation and Development) Act, 2016 (RERA) is one of the major regulations that has had a significant impact on India’s real estate market. The primary objective of the Act is to protect the interests of home buyers and also to promote fair practices in the real estate sector. The Act also seeks to bring in transparency and accountability in the real estate sector.

Apart from RERA, other regulations and policies that have a direct impact on the Indian real estate market include the Goods and Services Tax (GST), the Insolvency and Bankruptcy Code (IBC), and the Demonetization Act.

Emerging Trends in Indian Real Estate Market

The Indian real estate market is a dynamic and ever-evolving sector that has seen a remarkable transformation in recent years. From the introduction of innovative technologies and trends to the growth of the market, many emerging trends in the Indian real estate market have been gaining traction. From the adoption of green technology to the rise of smart cities, here are some of the top trends that are shaping the future of the Indian real estate market.

The concept of green technology is gaining traction in the Indian real estate market. From energy-efficient buildings to smart homes, green technology is being used to reduce the environmental impact of buildings. Furthermore, green technology is also being used to reduce the operational costs of buildings and make them more energy efficient.

Smart city development is another trend that is gaining traction in the Indian real estate market. Smart cities are being developed to provide a better quality of life to citizens. These cities are being developed to create a more efficient and sustainable urban environment.

The introduction of digital infrastructure is also enabling the Indian real estate market to grow. From online real estate platforms to virtual reality tools, digital technology is helping the real estate market to be more efficient and transparent.

Investment Opportunities in Indian Real Estate Market

The Indian real estate sector has been growing steadily in recent years, with several factors driving this growth. With the increasing demand for housing, infrastructure, and commercial spaces, Indian real estate offers investors an attractive opportunity to earn potential returns.

The Indian real estate market offers a diverse range of investment opportunities. From residential properties to commercial complexes, investors have a range of options to choose from. Additionally, the government’s push for affordable housing has opened up a range of investment opportunities in the affordable housing segment.

Investors can also benefit from several tax benefits such as tax deductions on loan repayments and the exemption of capital gains tax on the sale of real estate. This makes investing in real estate an attractive option for investors looking to maximize their returns.

The Indian real estate market is also becoming increasingly transparent, with the introduction of the Real Estate Regulatory Authority (RERA) and the Goods and Services Tax (GST). These regulatory reforms have made it easier for investors to understand the legalities of investing in real estate.

Challenges Faced by Indian Real Estate Market

The Indian real estate market has experienced significant growth in recent years, but there are still several challenges that must be addressed if it is to continue to thrive. From the complex regulatory environment to the lack of affordable housing, there are a variety of systemic issues that must be addressed to ensure the industry remains sustainable in the long-term. This article will explore the various challenges facing the Indian real estate market and discuss potential solutions.

First and foremost is the complex regulatory environment. Indian real estate laws are outdated, often conflicting, and rife with loopholes. This makes it difficult for developers to navigate the process and increases the risk of corruption. To address this, there needs to be a simplification of the regulatory environment, as well as increased transparency and accountability.

Another challenge is the lack of affordable housing. The cost of living in India is already high, and rising real estate prices are making it increasingly difficult for people to find an affordable place to live. To address this, the government needs to provide incentives for developers to build more affordable housing, such as tax breaks or subsidies.

Outlook for Indian Real Estate Market

The Indian real estate market is a booming one, offering a plethora of opportunities for investors. The market has seen an increase in demand for residential and commercial properties in recent years, as well as a rise in investments from foreign and domestic investors. With the Government of India taking steps to improve the regulatory environment, the outlook for the Indian real estate market is looking incredibly positive.

New projects are being launched in the country, many of which are focused on affordable housing. The government has also implemented several reforms to make the process of buying and selling property simpler and more transparent. These reforms have made the market more accessible to the public and have made it easier for investors to get involved.

The Indian real estate market is also set to benefit from the growth of the Indian economy. As the economy grows, so too will the demand for property, leading to increased investment opportunities. Additionally, the rise of the Indian middle class is expected to drive up demand for luxury and premium properties, providing further potential for investors.

FAQs About the India Real Estate Market

Q1. What types of property are available in the Indian real estate market?

A1. The Indian real estate market is highly varied and diverse, with different types of properties available including residential, commercial, retail, hospitality, industrial, and agricultural.

Q2. What factors affect the price of Indian real estate?

A2. The price of Indian real estate is affected by a variety of factors including location, availability of infrastructure, and market demand. Other factors such as government regulations, taxes, and inflation also play a role in determining the prices of real estate in India.

Q3. What are the trends in the Indian real estate market?

A3. The Indian real estate market is seeing an increase in demand for housing, particularly in the affordable housing segment. The focus of real estate developers is shifting to cities and Tier I and II towns, with buyers preferring ready-to-move-in properties and locations with good infrastructure and connectivity.

Conclusion

The Indian real estate market has shown tremendous growth in recent years due to increased demand from homebuyers and investors. The market is poised to continue to grow, as the government has made several reforms to make the sector more attractive to investors. The major drivers of growth in the Indian real estate market include the increasing population, growing urbanization, rising disposable income, and growing demand for quality housing. With the right policies in place, the Indian real estate market is likely to remain strong for the foreseeable future.