Industrial Real Estate Market

The industrial real estate market refers to the buying, selling, and leasing of industrial property for businesses and organizations. This market includes warehouses, manufacturing facilities, distribution centers, and other similar properties. It is a key component of a healthy economy and has seen significant growth in recent years. Industrial real estate offers companies the ability to expand their capacity quickly and efficiently, allowing them to stay competitive in the global marketplace. With the rise of e-commerce, the demand for industrial real estate is expected to remain strong shortly.

Trends in Industrial Real Estate

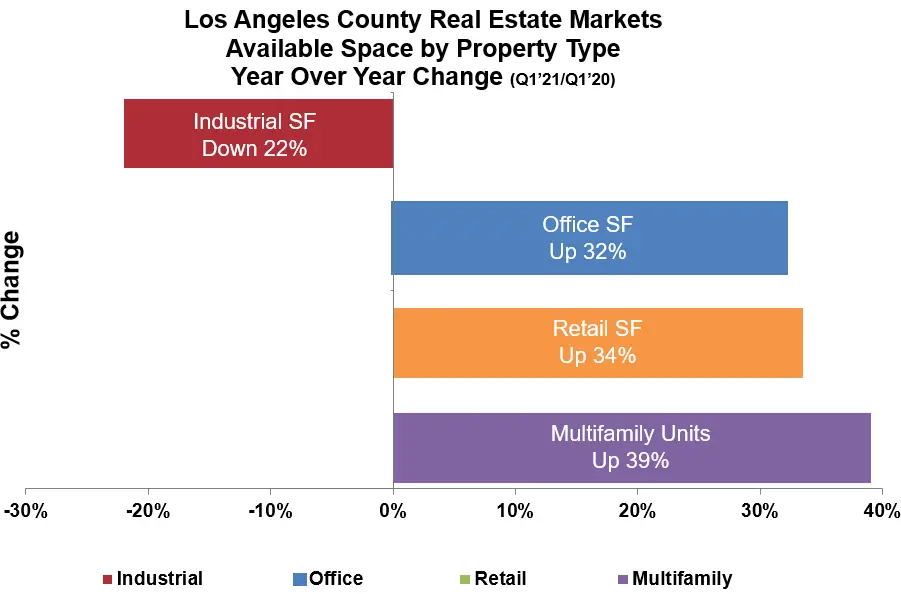

The industrial real estate market is constantly evolving, presenting opportunities and challenges for buyers and sellers alike. Recent trends in the industrial real estate market have included a shift towards e-commerce, increased demand for warehousing and manufacturing, and a shift towards smaller, more specialized properties. As a result, companies are looking for creative solutions to meet their needs and stay competitive.

E-commerce is a major trend in industrial real estate, as companies are increasingly turning to the internet to sell their products. As a result, industrial real estate developers are building warehouses and distribution centers to meet the needs of e-commerce companies. Additionally, these same developers are looking for ways to make their industrial properties more attractive to potential tenants, such as adding amenities like rooftop gardens, social areas, bike storage, and electric vehicle charging stations.

Another trend in industrial real estate is an increased demand for warehousing and manufacturing facilities. Companies are looking for larger, more specialized properties to meet their needs, and developers are responding by building larger facilities with a focus on automation and efficiency. As a result, industrial real estate is becoming a popular investment choice for investors looking for long-term returns.

Factors Influencing Industrial Real Estate Prices

Industrial real estate is a dynamic sector of the economy, with prices constantly fluctuating in response to a variety of factors. From location-specific trends to global market forces, it is important to understand the many elements that influence the value of industrial real estate. Existing market conditions, political influences, economic trends, and changes in the supply and demand of industrial real estate can all affect prices.

Location is one of the most important factors in determining industrial real estate prices. Factors such as population growth, infrastructure investment, and the availability of raw materials can all influence the value of industrial real estate in a particular area. Additionally, access to transportation and the presence of quality housing and amenities can make a particular industrial area more attractive to buyers.

The global economy can also have a major impact on industrial real estate prices. Factors such as economic growth, consumer confidence, and interest rates can influence the demand for industrial real estate, as well as the availability of financing. These conditions can affect the ability of businesses to buy or lease industrial real estate, and can have a direct impact on prices.

Finally, the supply and demand of industrial real estate can also influence prices. An increase in the number of industrial properties available for sale or lease can cause prices to drop, while a decrease in supply can result in rising prices. In addition, changes in the demand for industrial real estate due to changing consumer preferences or business trends can also have a significant impact on prices.

Overall, industrial real estate prices are affected by a variety of factors, from local trends to global market forces. A thorough understanding of these factors can help investors make informed decisions when buying or leasing industrial real estate.

Industrial Real Estate Investment Opportunities

Industrial real estate investment opportunities abound, and those who are willing to take the time to learn the ins and outs of the market can reap great rewards. With an ever-changing landscape of supply and demand, industrial real estate can provide attractive returns. Investors should be aware of the various types of industrial real estate investments available, which can range from warehouses to factories and other industrial properties. Investors should also consider the various factors that affect industrial real estate values, including the local economy, location, and other factors such as zoning, taxes, and infrastructure.

Additionally, investors should pay attention to the trends in industrial real estate, as this can help them identify potential areas of opportunity. Industrial real estate is often a long-term investment, so investors should consider their investment goals and the amount of risk they are willing to take on. Finally, it is essential to understand the complexities of the market, which include the factors that affect supply and demand, the various financing options, and the various legal considerations. With the right knowledge and strategy, industrial real estate can provide investors with a great opportunity for long-term growth.

Challenges Faced in the Industrial Real Estate Market

The industrial real estate market has been growing rapidly for the past few years, and it is expected to continue to grow in the coming years. Despite the market’s growth, several challenges can hinder its success. One of the biggest challenges facing the industrial real estate market is the lack of available land. As industrial space continues to get more expensive, businesses may have difficulty finding affordable and available land. Additionally, zoning restrictions can limit the amount of land that is available for industrial use.

Another challenge of the industrial real estate market is the competition. With more companies competing for the same properties, the competition can be fierce and drive prices up. As a result, sellers may have difficulty finding buyers or getting a good price for their properties.

Finally, the industrial real estate market is also subject to changes in the economy. When the economy slows down, businesses may have difficulty finding financing, and this can lead to a decrease in demand for industrial space. Additionally, changes in consumer preferences can affect the demand for industrial space, as businesses may need to switch to different types of properties.

Strategies for Successful Industrial Real Estate Investments

Investing in industrial real estate can be a lucrative business proposition, but it requires careful consideration and planning. To ensure a successful industrial real estate investment, investors should take into account current market conditions, location, and long-term trends. With a comprehensive understanding of the market, investors can make informed decisions and achieve positive returns.

When evaluating potential industrial real estate investments, investors should consider the current market conditions. It is important to research the local economy and identify industry trends, as well as the average market rate for rent and sale prices. Furthermore, investors should evaluate the location of the property and its proximity to transportation, amenities, and other services.

Investors should also research long-term trends in the industrial real estate market. This includes determining the current trends in the industry, as well as potential changes in the future. This allows investors to better understand the potential risks associated with an investment so that they can make informed decisions.

Government Regulations and Policies Affecting Industrial Real Estate

Government regulations and policies play a critical role in the industrial real estate market. These regulations provide stability to the industry, protecting buyers and sellers alike from potential legal and financial risks. In the United States, federal laws such as the Clean Air Act, the Clean Water Act, and the Occupational Safety and Health Act are just a few examples of regulations that affect industrial real estate. On the state level, zoning laws, building codes, and environmental regulations can also impact the industrial real estate market. In addition, local governments often have their regulations that must be adhered to when buying, selling, or leasing industrial real estate.

The ever-evolving nature of government regulations and policies can make it difficult for industrial real estate buyers and sellers to stay up to date. It’s important to be aware of any changes in laws or regulations that could affect a particular property or transaction. For instance, the introduction of new environmental regulations could affect the value of an industrial property or the cost of operating machinery on the premises.

Ultimately, buyers and sellers of industrial real estate should be aware of the laws and regulations that affect their transactions. Understanding the potential risks and benefits associated with government regulations can help buyers and sellers make informed decisions when it comes to industrial real estate.

Economic Impact of the Industrial Real Estate Market

The industrial real estate market has become a major factor in economic growth and development. As businesses expand, they need larger and more efficient warehouses and factories to accommodate their production needs. This has caused the industrial real estate market to rapidly grow in recent years. With this expansion comes a great deal of economic impact, both positive and negative.

On the positive side, the industrial real estate market can lead to job creation and increased tax revenue. Businesses that require larger warehouses and factories often have to hire more employees to manage the increased production needs. This can lead to an increase in the local tax base, as businesses are taxed for their profits. These taxes can be used to fund public projects, like infrastructure improvements, that benefit the entire community.

On the negative side, the industrial real estate market can lead to an increase in pollution. The production of goods that require larger industrial spaces often leads to an increase in air, water, and soil pollution. This can lead to the degradation of local natural resources and hurt the health of residents.

FAQs About the Industrial Real Estate Market

1. What is the current state of the industrial real estate market?

Answer: The industrial real estate market has been steadily growing in recent years, with increasing investment activity and demand for industrial space. The sector has seen strong rental growth, robust occupancy levels, and rising construction activity.

2. What are the key factors driving the growth of the industrial real estate market?

Answer: The growth of the industrial real estate market is being driven by e-commerce, technological advancements, and the need for modern logistics infrastructure. These factors have created an increased demand for industrial space, which has led to higher rental rates and stronger occupancy levels.

3. What types of industrial real estate are available?

Answer: Industrial real estate can range from warehouses, distribution centers, and manufacturing facilities to light industrial and flex space. Each type of industrial real estate offers different features and benefits, and the right type of property will depend on the specific needs of the business.

Conclusion

The industrial real estate market is a dynamic and ever-growing sector with numerous potential investment opportunities. With the continued growth of e-commerce, the need for warehouses and other industrial space is expected to remain strong. Investors should remain aware of the trends and developments in the industrial real estate market to take advantage of the best investment opportunities.